Over the past few years, my main focus has shifted from security in the cloud to security of the cloud. Yet I have never stopped following the Application Security (AppSec) market. It is still one of the most dynamic and fast-moving areas in cybersecurity. I keep an eye on both the commercial and open-source sides, not only because of professional curiosity but also because I find the evolution of this market fascinating.

One thing that keeps catching my attention is the same pattern repeating everywhere. Almost every AppSec vendor, whether small, mid-sized, or global, is now trying to become a platform. If you started as a company offering only SAST, now you are expected to offer DAST, SCA, API security, IAST, IaC scanning, container scanning, secrets detection, and even Application Security Posture Management (ASPM). The market seems to be sending a clear message: if you want to stay relevant, you must do it all.

At first, I thought this trend was simply a reaction to a competitive market. There are too many players, and differentiation is hard. Every vendor is fighting to stay visible, so expanding into new areas looked like a logical business move. But after watching this space closely for several years, I realized that something deeper is driving this behavior. The real reason, in my view, is Gartner.

Gartner’s role in shaping the AppSec market is impossible to ignore. Its Magic Quadrant for Application Security Testing (AST) has become the unofficial scoreboard of the industry. When Gartner changes the evaluation criteria, the entire market reacts. Vendors redesign their roadmaps, launch new features, and even acquire other companies just to meet those updated expectations.

Gartner’s “completeness of vision” and “ability to execute” criteria naturally favor broad, platform-style offerings. Companies that excel in one specific area rarely reach the Leader quadrant. Success requires checking boxes across the entire software development lifecycle.

That is why we now see vendors transforming themselves into platforms. Checkmarx One is no longer just a SAST tool but a complete AppSec suite. Tenable One and Wiz CNAPP are expanding their coverage to include application and cloud posture in a single view. Even Invicti’s recent acquisition of Kondukto.io is part of the same movement. Everyone is building a “one-stop shop” for security testing, vulnerability management, and posture visibility.

Personally, I find this transformation both exciting and concerning. On one hand, it simplifies life for organizations that want a single pane of glass for their AppSec needs. On the other hand, it can limit innovation by forcing every vendor to chase the same broad checklist rather than focus on what they do best.

So when I read Gartner’s Magic Quadrant for Application Security Testing 2025, I am not only looking at who sits where on the chart. I am more interested in understanding the story behind it. What do these placements tell us about the market’s direction? Are vendors truly evolving because customers demand it, or because Gartner is setting the rules of the game?

These are the questions that shaped my reading of this year’s report and triggered me to write this post.

What “Becoming a Platform” Really Means

When I say every AppSec vendor is becoming a platform, I mean it literally. A few years ago, companies specialized: SAST vendors, DAST specialists, dependency scanning tools. Today, those boundaries have blurred. Everyone now covers the entire software development lifecycle from code to production.

The idea of a “platform” in AppSec means offering an integrated set of capabilities that cover all possible attack surfaces of an application and its supply chain. It means going beyond just finding vulnerabilities and adding layers like policy management, risk prioritization, SBOM handling, and developer enablement. In short, a platform is no longer only about scanning code. It is about managing risk, automating workflows, and showing executives how their application portfolio aligns with overall business risk.

When I looked at Gartner’s latest Magic Quadrant for Application Security Testing (October 2025), this definition was reinforced once again. The report explicitly mentions capabilities such as SAST, DAST, IAST, SCA, API testing, secrets detection, IaC scanning, container security, and posture management as part of what they consider “common features.” These expectations are almost identical to what platform vendors now promise on their websites.

In my view, this is not a coincidence. Gartner’s criteria have become a roadmap for how vendors design their portfolios. If you are a vendor and you want to move closer to the Leader quadrant, you cannot ignore this. You need a story that touches every part of the software development process, whether you build it in-house, buy it, or partner with someone else.

This is why we keep seeing acquisitions and integrations. Checkmarx One, for instance, built a unified experience around its scanning tools and posture management. Tenable One expanded beyond vulnerability management to include application risk visibility. Wiz CNAPP combined multiple layers of cloud and application posture in a single interface. Even Invicti’s acquisition of Kondukto.io earlier this year fits perfectly into this pattern.

From a vendor perspective, this move makes sense. A platform brings stronger positioning, higher deal sizes, and a better chance of being viewed as “strategic” by customers. But from a market perspective, it raises an interesting question: are we truly improving AppSec, or just broadening it?

The risk here is that by trying to be good at everything, vendors might lose focus on what originally made them valuable. A smaller company with deep expertise in a specific domain could deliver more meaningful results than a large platform trying to do it all. But the reality is that Gartner’s influence pushes everyone to aim for scale and completeness.

Personally, I think the future will belong to those who can combine both: the breadth of a platform and the depth of focused innovation. Vendors that manage to unify visibility, automation, and developer experience without sacrificing technical quality will stand out.

And that is what makes this year’s Magic Quadrant so interesting to read. It is no longer just a reflection of who leads in scanning technology. It is a snapshot of who has successfully adapted to this new definition of “platform.”

How Gartner Shapes the AppSec Market

After following the AppSec market for several years, one thing is clear: Gartner doesn’t just describe markets — it defines them. The Magic Quadrant for Application Security Testing acts more like a compass than a mirror. It shapes how vendors design products, how investors evaluate them, and how buyers create shortlists.

When you read the 2025 report carefully, this influence becomes obvious. The “Ability to Execute” and “Completeness of Vision” criteria are not just academic measurements. They are powerful incentives that drive the entire industry. Vendors know exactly what Gartner expects under each dimension, and they align their strategies accordingly.

For example, under Ability to Execute, Gartner looks at things like product capabilities, market viability, customer experience, and sales effectiveness. That might sound neutral, but in reality, it favors vendors with strong financial backing, large global teams, and wide market coverage. It is hard for a small or highly specialized vendor to compete with that, no matter how innovative their technology might be.

Then comes Completeness of Vision, which covers areas like innovation, product strategy, and market understanding. Again, this sounds fair on paper, but it naturally rewards those who present a broad and future-looking story. A company that focuses deeply on a single domain, like SAST or API security, may appear less visionary simply because its scope is narrower.

I have mixed feelings about this model. Gartner’s structure helps enterprise buyers make confident decisions in a complex field. But it also pushes vendors toward conformity: many try to “tick every box” instead of doubling down on their strengths.

This pattern is easy to observe. Over the last few years, we have seen an increasing number of acquisitions, partnerships, and product bundles that exist mainly to fill coverage gaps rather than to solve specific customer problems. The goal is often not to build the best solution for a single use case, but to look more complete in Gartner’s evaluation.

To be clear, I am not criticizing Gartner for setting these standards. Their framework reflects real customer needs: organizations do want integrated platforms and broader visibility. However, I think the balance between breadth and depth is starting to tilt too far toward breadth. Many vendors now prefer to showcase the number of modules they have rather than the quality of the results they produce.

That is why I find it more valuable to read the Magic Quadrant not as a ranking but as a reflection of market psychology. It tells us where the collective attention of vendors and buyers is going. In 2025, that direction is clear: toward platform consolidation, automation, and AI-assisted workflows.

The question that remains is whether this direction truly improves security outcomes or simply reshapes how we measure success. I will come back to that point later, but for now, it is clear that Gartner’s criteria have become the silent architect of how modern AppSec evolves.

The 2025 Landscape: Who’s Leading and Why

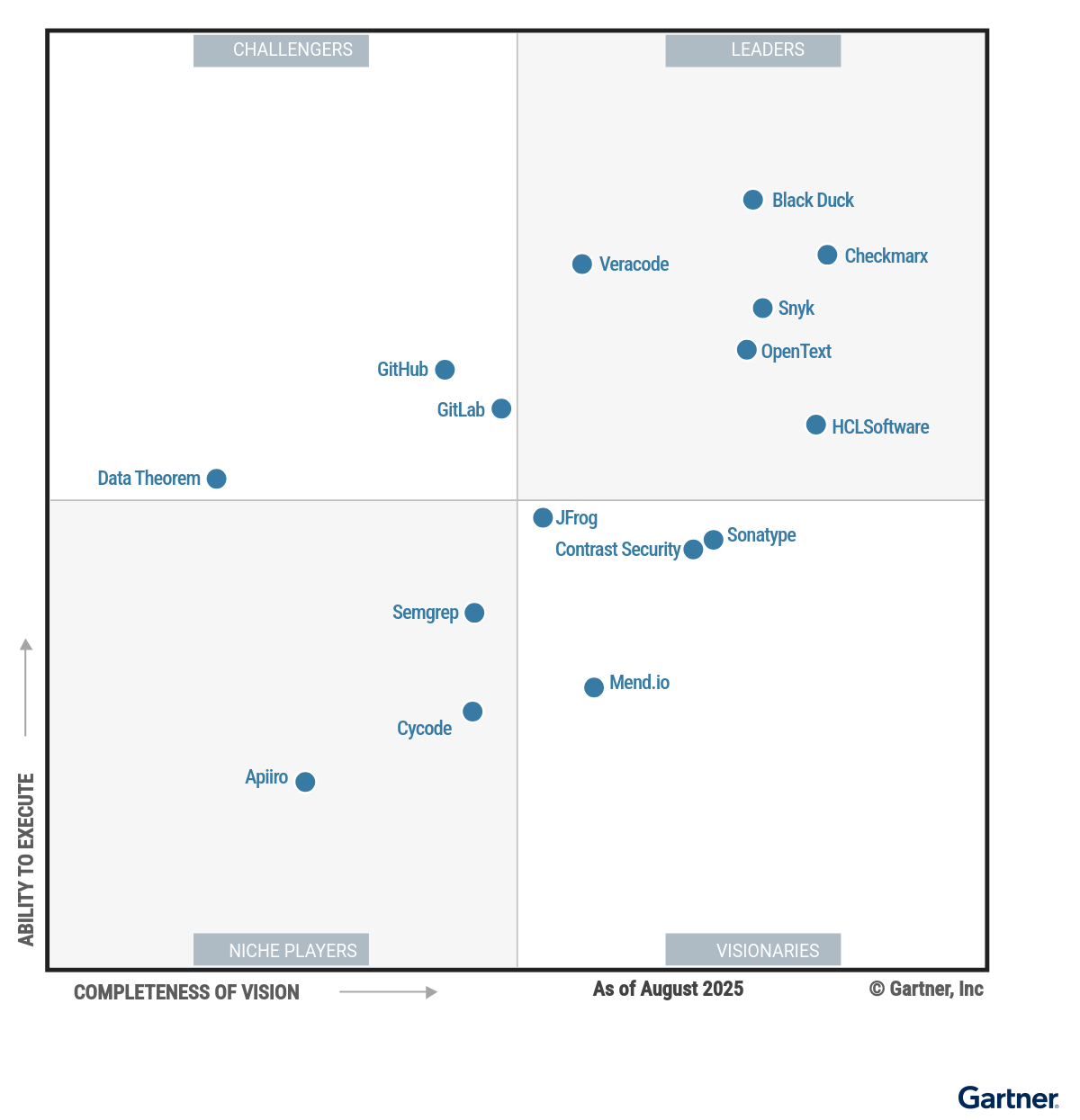

Before diving into my interpretation, it is useful to look at the current picture of the market. Here is Gartner’s 2025 Magic Quadrant for Application Security Testing, which visually summarizes how the major vendors are positioned.

Looking at the 2025 quadrant, a few things immediately stand out. The first is how crowded the Leader area has become. We now have vendors such as Snyk, Checkmarx, Veracode, Black Duck, OpenText (Fortify), and HCLSoftware (AppScan) all grouped in the same region. Each of them represents a mature, full-spectrum platform that touches nearly every part of the software development life cycle.

Gartner highlights these vendors for their depth of capabilities, broad language support, strong developer integration, and the ability to tie together application and supply chain risks. I agree with this observation. These vendors have invested heavily in creating unified experiences that go beyond scanning. Many now combine static, dynamic, and composition analysis with posture management and AI-assisted remediation. That combination is what Gartner values most today.

However, I also think that being a Leader does not automatically mean being the most innovative. Most of the names in that top-right quadrant are large and well-established. Their focus has shifted from innovation speed to integration depth. They are building ecosystems rather than individual tools. This brings stability for enterprise buyers but sometimes limits the pace of experimentation.

On the other side of the chart, we see the Visionaries such as Sonatype, Contrast Security, JFrog, and Mend.io. I find this group particularly interesting because they are usually the ones introducing fresh ideas. Sonatype continues to push boundaries in software supply chain security. Contrast Security is still leading in interactive testing (IAST) and runtime protection. JFrog and Mend.io are combining software delivery pipelines with security intelligence in ways that challenge traditional testing models.

In my opinion, this quadrant is often where the future starts. Many of the ideas that are now considered standard (like SBOM visibility or automated remediation) first appeared among Visionaries before becoming mainstream.

The Challengers category includes GitHub, GitLab, and Data Theorem, each with a strong foundation but still building the wider vision Gartner expects. GitHub and GitLab are a good examples of how DevOps and AppSec are merging. Both have integrated security into the development workflow itself, which I personally see as one of the healthiest trends in this market. Security that lives inside the developer environment will always have a better adoption rate than a tool that lives outside of it.

Finally, there are the Niche Players such as Semgrep, Cycode, and Apiiro. I have a soft spot for this group. While they may not appear as powerful on Gartner’s chart, they often represent the most authentic engineering innovation in AppSec. Tools like Semgrep are widely adopted in developer communities because they are lightweight, transparent, and flexible. Cycode and Apiiro are also making real progress in correlating risks across the software supply chain, even though they operate with smaller teams compared to the giants in the Leader quadrant.

Gartner’s quadrant, in my view, reflects more than performance metrics. It reflects strategy and scale. Leaders win on breadth and stability, Visionaries win on creativity, Challengers win on integration, and Niche Players win on focus. All four groups play an important role in shaping the ecosystem.

What this year’s quadrant tells me is that the market is maturing. The fight is no longer just about who has the best scanner. It is about who can connect everything — from code to runtime, from vulnerability detection to posture management, and from security teams to developers.

At the same time, I think Gartner’s heavy focus on platforms means that smaller innovators might need to find alternative ways to stand out. Some will partner with larger vendors, while others will double down on specific niches like AI security or pipeline protection. Either way, 2025 feels like the year when the AppSec market truly crossed from tool-centric to platform-centric thinking.

AI: The New Differentiator or Just Another Checkbox?

It is impossible to talk about the 2025 AppSec landscape without mentioning artificial intelligence. Every vendor now talks about AI. It has become the central theme of product launches, press releases, and marketing pages. In the latest Magic Quadrant for Application Security Testing, Gartner highlights AI not only as a driver of new risks but also as a key differentiator among vendors.

According to the report, the adoption of generative AI tools in software development has exploded. Nearly half of development teams now use AI-assisted coding tools, and most engineering leaders report measurable productivity gains. However, this acceleration comes with a cost. Gartner notes that AI-generated code is often less secure, with many organizations seeing little or no improvement in the quality of their code security. I completely agree with this point. Productivity and security rarely grow at the same pace.

We are now entering a phase where AI creates as many problems as it solves. On one side, AI helps developers move faster, automate fixes, and detect patterns that traditional scanners miss. On the other side, it introduces new categories of vulnerabilities such as prompt injection, model manipulation, and data leakage through LLM integrations. The balance between speed and safety is still fragile.

In response, vendors are racing to build AI-driven security assistants and remediation tools. GitHub Copilot Autofix, Veracode Fix, Snyk’s AI remediation, and Checkmarx’s AI Security Champion are all examples of this new generation of features. These tools aim to help developers correct vulnerabilities automatically or at least guide them with smarter recommendations inside their IDEs. I think this is a healthy direction, as long as it stays grounded in accuracy. Automation can reduce the time to remediate, but if the fix is wrong or incomplete, the overall risk may even increase.

Gartner also points out that many vendors are still in the early stages of addressing AI-specific risks. Most of the current “AI coverage” is limited to detecting vulnerable open-source libraries or models used in building AI systems. Very few tools can test the behavior of an AI-enabled application or assess the trustworthiness of its outputs. I think this is where the next wave of innovation will happen. Security testing must evolve beyond static analysis of code and move toward dynamic analysis of behavior, especially for systems that learn or adapt over time.

What I find interesting is how AI has already become a checkbox item for many vendors. If your product does not include something labeled “AI-powered,” you risk being perceived as outdated. This marketing pressure can lead to shallow implementations that sound impressive but deliver limited value in real-world environments. I have seen several examples where AI features exist more for visibility in the quadrant than for actual effectiveness.

Still, I believe AI will eventually reshape AppSec in a more meaningful way. The question is when. The tools that will truly stand out are those that can use AI not just to fix issues faster but to understand context better. For example, tools that can distinguish between exploitable and non-exploitable findings, or that can adapt their recommendations based on an organization’s architecture and risk profile, will bring real progress.

So, is AI the new differentiator or just another checkbox? For now, it is both. It is the hottest topic in AppSec, but it is also an area full of noise and exaggeration. As buyers, we need to separate genuine innovation from clever marketing. And as professionals in this field, we should keep reminding ourselves that AI is a tool, not a strategy. True differentiation will come from how intelligently it is used, not from how often it appears in product brochures.

What This Means for Security Leaders and Vendors

After reading Gartner’s 2025 report and comparing it with what I have observed in the field, I think the AppSec market is standing at a very interesting crossroads. The industry has matured enough to deliver complete platforms, yet it is still young enough to be influenced by rapid technological change, especially around AI and automation. For both security leaders and vendors, this combination creates new opportunities and new risks.

For security leaders, the challenge now is not the lack of tools but the excess of them. The number of available solutions, features, and integrations can feel overwhelming. Many platforms claim to do everything from code scanning to runtime protection, but their actual depth in each area often varies. It is easy to end up with overlapping tools that create more complexity instead of reducing it.

Gartner’s 2025 quadrant gives an advantage to vendors that can provide end-to-end coverage. This helps large enterprises that want to consolidate tools and manage everything from a single platform. However, I believe leaders should still be careful not to let the “platform promise” replace practical evaluation. The best solution is the one that fits your environment, not necessarily the one that sits highest in a quadrant. Sometimes, a focused vendor that integrates well into your existing workflows can deliver better results than a broad platform that tries to control everything.

From an architectural perspective, the most successful AppSec programs I have seen are built on two core ideas: visibility and collaboration. Visibility means understanding what you have, where your risks are, and how those risks connect across your software supply chain. Collaboration means bringing developers, DevOps, and security teams together under shared goals rather than separate tools. Many of the new ASPM solutions are moving in this direction, and I think that is a healthy sign.

For vendors, the message from Gartner is equally clear. The market now rewards integration, correlation, and automation. Vendors that can connect multiple layers of the SDLC into a single experience will continue to climb the chart. But at the same time, I think there is still plenty of room for specialization. Some of the most impactful innovation in AppSec still comes from smaller, niche players who focus deeply on one problem, such as API security, pipeline protection, or developer education.

The real winners in the long term will be the vendors who can balance these two forces. They will combine the scale and completeness of a platform with the precision and clarity of a specialized tool.

The market no longer needs just more scanners. It needs intelligent systems that can prioritize, explain, and even act automatically without overwhelming the developer.

I also think this evolution will push organizations to rethink how they measure success. The question should move away from “How many vulnerabilities did we find?” toward “How quickly and accurately did we fix the ones that truly matter?” The difference between those two questions is where real maturity in AppSec begins.

In the end, Gartner’s influence is undeniable, but the direction of the market is still in our hands. Security leaders decide what to buy, and vendors decide what to build. If both sides focus on practical value rather than positioning, the AppSec ecosystem can continue to grow in a healthy and innovative way.

A Personal Look at Where AppSec Is Going

The AppSec market has entered a new phase. The conversation has shifted from tools to platforms and ecosystems. Vendors no longer compete on finding vulnerabilities — they compete on managing, prioritizing, and remediating them at scale. This change reflects a decade of evolution driven by customer expectations, technology progress, and Gartner’s influence.

When I look back at the earlier years of the Magic Quadrant for Application Security Testing, the focus was mainly on technical coverage and detection accuracy. Today, the focus has expanded to include posture management, automation, and AI. This evolution reflects how the world of software has changed. Applications are now connected to pipelines, containers, APIs, and machine learning models. Security can no longer be an isolated activity that happens just before deployment. It needs to be a continuous process that lives inside development itself.

Gartner’s 2025 report captures this reality quite well, even if it sometimes overemphasizes completeness over specialization. I think their role in pushing the market forward is both powerful and necessary. At the same time, it reminds me that AppSec is not only about meeting a set of criteria. It is about solving real problems for real people who build and run software every day.

As for the future, I believe the next big differentiator will not be how many scanning capabilities a platform includes, but how well it helps organizations make sense of all the findings. Noise reduction, contextual prioritization, and smart remediation will matter more than raw detection power. The winners will be the vendors who can bridge the gap between technical detail and actionable insight.

For me personally, following this market has become less about who wins a quadrant and more about understanding the patterns behind it. The story of AppSec is the story of balance. It is about balancing speed and security, innovation and integration, automation and human judgment. That balance is what will define the next generation of application security.

And if there is one lesson to take from the 2025 Magic Quadrant for Application Security Testing, it is that the market never stands still. New risks, new technologies, and new expectations will keep shaping it. The only constant is change, and that is exactly what makes AppSec such a fascinating field to follow.